Health insurance benefits—

a Headway Guide

From deductibles to cost changes, understanding your benefits can be confusing. Here’s a quick guide to get you up to speed.

How benefits work

Your benefits tell you what care your plan will pay for, and how much of the cost it will cover

How does health insurance work?

When you sign up for an insurance plan, you agree to a contract. Typically, you pay a monthly premium, or fee, to your insurer, and in exchange, that insurer covers various costs related to your care. This can include anything from a routine office visit to a trip to the emergency room. Having an insurance plan can give you peace of mind by keeping your monthly costs predictable and manageable, even in the event of an unexpected health cost.

For each plan, some providers are considered in-network, while others are out-of-network. This status impacts how much you’ll pay for care.

In-network

A provider is in-network if they accept your insurance plan. You can check to see if a mental health provider is in-network with your plan directly from Headway’s website.

Headway’s goal is to greatly expand the number of in-network providers across all insurance plans nationwide.

or

Out-of-network

A provider is out-of-network if they do not accept your insurance plan.

Note that some insurance plans may still pay for part of the cost of an out-of-network provider, but you will save less money by choosing them.

If you’re booking on Headway, you’ll only be able to book with in-network providers.

Mental health coverage

Today, most plans include some sort of coverage for mental health care. That said, some do not. You can check your mental health coverage for your current plan by doing any of the following:

- Enter your insurance plan details on Headway to see if we can instantly verify

- Visit your insurance company's website or app

- Review your EOB (explanation of benefits) and look for details on "behavioral health benefits"

- Call your insurance company directly to ask

How much you pay and why

The exact amount you pay for care is based on a few key details from your plan

Deductible, copay, coinsurance, out-of-pocket max

If your plan includes mental health benefits, these factors will typically have the greatest impact on what you pay. Headway works with your insurance company to understand these parts of your plan and determine your cost per session.

Deductible

A deductible is a set amount of money you must spend before your insurer pays for some of your care. With these plans, the out-of-pocket price per session is set by your insurance company. Once you’ve reached your deductible amount, your insurance company will start to contribute to your therapy costs. The percentage they then pay is determined by your plan.

Copay

A copay is a flat rate per session set by your insurance plan. With a copay, you’ll pay the same amount for each session regardless of type or length. Your insurer covers the rest.

Coinsurance

The coinsurance is the percentage of the session cost you're responsible for paying after your deductible’s been met. Your insurance covers the remaining percentage. For example, if your coinsurance is 10%, you pay 10% and your insurer pays 90% of the session cost.

Out-of-pocket max

Your out-of-pocket max is the most money you’ll pay for in-network care in a given plan cycle (a cycle usually lasts 1 year). In most cases, once you reach this number, you’ll no longer need to pay a copay or coinsurance, and you’ll owe $0 per session, until your plan resets for a new cycle.

Why costs change

Your costs can change—overnight—for a few key reasons

Common cost changes and why they happen

Over the course of a year, your in-network costs per visit will often go down as you progress through your plan. This is because most plans cover more of your costs the more you spend. That said, your costs can sometimes go up as well. Here are two examples:

1. Your cost per session decreases for future sessions. This usually happens when you reach your deductible or out-of-pocket max, which means your insurance plan is working as intended! You’ll benefit from lower costs for the rest of your plan cycle.

2. Your cost per session suddenly goes back up. Typically, this happens because your plan cycle just ended and your benefits reset. For many plans, this happens on January 1, but it can vary depending on your particular insurer or employer. This means your plan is working as intended, and you’ll usually only pay this higher cost temporarily

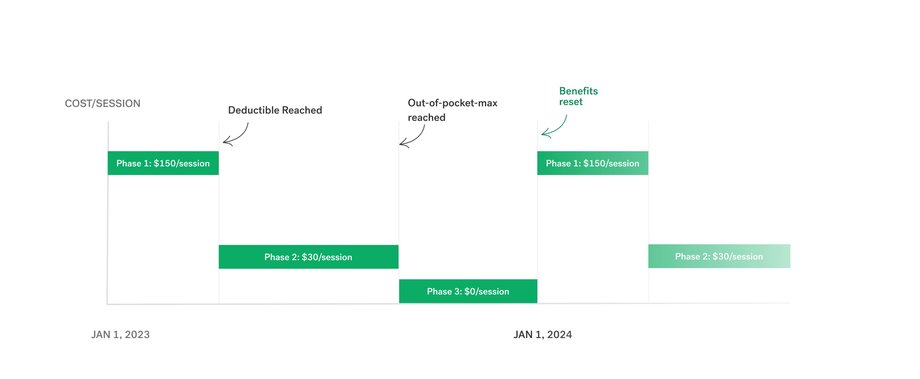

Let’s break down an example of how these two changes might play out over time.

As a combined example of the two cases above, consider a fictitious client named Jane. Note that all of these dollar amounts will vary depending on the plan.

- Phase 1: Jane starts the year paying full cost ($150) for each therapy session.

- Phase 2: After paying $150 for 10 sessions, she reaches her deductible of $1,500. She must now only pay a 20% coinsurance per session, or $30. Her insurer covers the remaining 80% ($120).

- Phase 3: Later in the year, Jane has spent enough of her own money on therapy to reach her out-of-pocket max. Her insurer covers the full cost of each session for the rest of the year, and Jane pays $0 per session.

- Back to Phase 1: Jane's plan resets on January 1, and she goes back to paying $150 per session until she reaches her deductible again in her new plan cycle.

When your insurance benefits reset, usually around January 1st, cost changes and plan updates can get confusing. Our team is here to help make these changes as easy to understand as possible, and to get you an accurate cost as soon as we can.

Sithara

Insurance operations at Headway

Benefit resets

Most issues during a benefit reset can be resolved quickly

How to navigate benefit resets

As outlined above, your session cost might temporarily increase when your benefits reset. You can confirm with your insurer or ask your employer to double check your reset date to confirm this is what happened. That said, a few other situations tend to occur during benefit resets that are a bit more complicated. Here are some common things that can happen after a reset, and what you can do in each case.

Benefit resets and what you can do

- Check your insurance portal to see if your benefits just reset. For many people, this will happen on January 1, but it can also happen at other times of the year, depending on your employer and plan.

- Ask your employer. Your organization will also know if you just had a reset, and any other relevant info about your plan. If you just had a benefits reset, a change like this is normal, and your cost will typically go back down after you reach your deductible.

- Ask your insurer. It’s also possible your insurer made a larger structural change to your insurance, like changing copay or coinsurance rates for your plan, or, more rarely, actually removing mental health benefits from your plan. If you’re on Headway, we’ll do our best to detect this sort of change as well, though your insurer will be able to confirm.

- If you have enrolled in an entirely new plan, you likely have new copay or coinsurance amounts, as well as a new deductible and out-of-pocket max, all of which may have impacted your session costs.

- It’s possible your insurer made a larger structural change to your insurance, like changing copay or coinsurance rates for your plan. More rarely, it's possible that you no longer have mental health benefits as a result of recent plan changes. If you’re on Headway, we’ll do our best to detect this sort of change as well, though your insurer will be able to confirm.

- Telehealth (virtual) sessions may have different benefits than in-person sessions.

- Different types of care (like longer sessions or getting prescribed medication) have different rates than more typical talk therapy sessions.

- Wait a few days. A reset period is the busiest time of year for insurers, with errors and other outages most common in the first few days. If you're confident your information is correct, and your care isn't urgent, many issues will resolve after a few days.

- Book sessions with Headway's best cost estimate. If insurer systems go down in January, Headway will continue to contact your insurer to get an estimate for your upcoming sessions. We'll do our best to get you the best estimate we can so you can continue to access care.

- Fix typos. If you filled out a form for that provider or service, check that your name, date of birth and member ID exactly match your insurance card. Sometimes fixing a single typo solves the problem.

- Update with your latest insurance information. Sometimes a provider or service will still have information from last year’s plan, which will make it seem like some benefits are missing.

- Make sure the information on file matches your insurance card exactly. Double check everything is up to date.

- Search for a new provider. If you’re on a new or updated plan, it’s possible your old provider isn’t covered, but a new one is.

- Use private pay. You won’t save as much, but you can still see out-of-network providers.Read our full article on medical necessity.

Helpful resources

Other commonly asked questions

While benefits most commonly reset on January 1, there are several exceptions. For example, many employers offer coverage that resets at a different time of the year. In these cases, all the same rules apply: they just reset at this different date (e.g. November 1 instead of January 1).

A month or so before your benefits reset, you’ll often have a chance to make changes to your insurance choices. This period is called “open enrollment,” and most commonly happens when you have health insurance through an employer. During this time, you can usually make a variety of decisions, such as:

- Making no changes and keeping the same benefits you already have

- Making small changes, such as paying a slightly higher or lower monthly premium, in exchange for things like your copay or deductible going up or down

- Making a bigger change, like selecting a brand new insurance plan

Any changes you make during open enrollment will take effect as soon as your benefits reset.

Note that some changes to your plan may end up being out of your control, such as when your employer updates which plans are available to you, or when an insurer makes changes to its benefit offerings. In these cases, you should still be able to see what’s new during open enrollment.

It’s likely your plan benefits changed in some way following a reset. You may have made new selections during an open enrollment period, or your insurer might have changed benefit details on their end. Either way, this is a common situation for most plans.

As a general rule, the more you pay in monthly premiums, the lower your other fees will be. Usually, you’ll have the option of selecting from a plan that has high monthly fees, but low copays and deductibles, vs. a plan with low monthly fees, but high copays and a high deductible.

If you anticipate going to lots of therapy sessions or doctor visits, paying a higher monthly fee is often the best choice, as you’ll save a lot more money in the long run on your appointments.

Getting help

Headway is here to provide the support you need.

Find answers to common questions from Headway clients

If you're already a client on Headway, you can review your latest benefits here.

For additional questions about compliance or Headway in general, contact our support team.

Disclaimer

This document should be used for general informational purposes only. The contents do not constitute legal or health advice and should not be used as a substitute for advice from legal counsel or a medical professional. Use this page as a reference guide, not as a definitive source of information regarding health insurance plans.